What a journey 2011 has been. Here’s a quick summary to show just how far we’ve come in the campaign for an FTT:

January:

President Sarkozy reiterated his call for an FTT at the World Economic Forum in Davos, placing the Robin Hood Tax on the top of the international political agenda. Also speaking at the event financier George Soros echoed the President’s words. The Executive Director of Oxfam, Barbara Stocking and the General Secretary of the International Trade Union Congress also welcomed the President’s sentiments.

“Bankers and financiers must begin to understand that they have a real responsibility to the real economy.”

February:

Campaigners from 25 countries united to call for the G20 to deliver a tax on the banks.

From Argentina to Australia, Spain to Senegal, and Brussels to Brazil, thousands of people and organisations took part in the protest. These governments were, and still are, key in securing an international deal on the FTT.

The Robin Hood idea really caught on with Spanish merry men presenting a giant Robin Hood arrow to the French Ambassador in Madrid; French Monsieur Robin des Bois helping to launch a new campaign at the old Stock Exchange building in Paris and Nepalese campaigners from various development organisations visiting the British and French embassies dressed in traditional Robin Hood attire: masks and tights, of course.

March

The European Parliament voted in favour of a €200bn (£172bn) a year Robin Hood Tax. This bold move set the global precedent for moving ahead with action on the banks. This was when the pieces for a Europe-wide FTT really started falling into place. By this point we had the support of Germany, France, Spain, Austria AND the European Parliament. Big progress.

Also, as a result of people like you asking your MPs to vote, the following MEPs came out in support:

>> All Labour MEPs

>> Both Green MEPs

>> The Plaid Cymru MEP in Wales

>> The Sinn Fein MEP in NI

>> 2 Lib Dem MEPs

On March 26th Robin Hood supporters joined thousands of protestors in London marching for an alternative to the cuts.

April

1,000 economists (including Nobel Laureates) from 53 countries wrote to G20 finance ministers and Bill Gates calling on them to introduce financial transaction taxes to tackle global poverty and climate change and help people hit by the economic crisis.

Professors from many of the world’s leading universities, including Harvard, Oxford, Cambridge and the Sorbonne signed the letter. Signatories include Jeffrey Sachs, Director of the Earth Institute at Colombia University and influential advisor to UN Secretary General Ban Ki-moon; Dani Rodrik from Harvard; and Ha Joon Chang from Cambridge.

May

The French bank Credit Cooperatif broke ranks and decided to implement an FTT, which was an important first.

Owen Tudor, spokesperson for the Robin Hood Tax campaign summed this up nicely:

“Crédit Coopératif’s action disproves critics’ claims that a Robin Hood Tax is hard to implement and shows what we could achieve if the rest of the financial sector were asked to show such generosity. Excuses for not asking banks to pay their fair share to society are wearing thinner by the day.”

June

As bankers had their annual champagne-fuelled Mansion House Banquet, the Robin Hood Tax campaign set up it’s own super casino opposite to remind them of the real life consequences of their reckless gambling. The event appeared on all the major news channels, with footage of ‘bankers’ betting monopoly money on health workers, patients, public service workers and mortgage owners, on a life-sized roulette board.

Robin had a busy month in June with actions in 43 countries across 5 continents. People in all corners of the world united in sending out a message to the financial sector: it is time to help solve the crisis that you caused.

The day kicked of with a stunt in New Zealand >>

Nepalese activists visited the Deputy Prime Minister >>

Robins rolled euros in Berlin >>

Our heroes the nurses marched on Wall Street >>

Robin Du Bois descended on the G20 agricultural ministers meeting in Paris >>

Many more to boot >> [my personal favourite; Australian Robins]

These events were fun and creative but carried a serious message with them: the reckless behaviour of the financial sector has had adverse impacts around the globe and it is time that world leaders took notice and backed an FTT which would go some way towards remedying these injustices.

And finally, the European Commission proposed an EU-wide FTT, the announcement came as a new Eurobarometer poll of more than 27,000 people showed that 61% of Europeans are strongly in favour of an FTT. In the UK, 65% were in favour of an FTT.

Max Lawson, spokesperson for the Robin Hood Tax campaign said:

“Today marks a real turning point. It’s great news that the Commission has joined the millions of ordinary Europeans who want the financial sector to contribute more to society. But this tax will only win popular support if the revenue is used to tackle poverty and climate change – not if it disappears into the general EU budget.”

July

Robin Hood goes to no.10 Downing Street

2 big things:

1) Robin Hood campaigners went all the way to no.10 Downing Street to deliver a letter to David Cameron urging him to adopt an FTT to combat poverty in the UK and abroad.

2) The Brazilian government introduced a 1% transaction tax on currency derivatives in order to limit foreign exchange speculation. This was a big step for Brazil and provided further evidence to European leaders of the feasibility of implementing unilateral FTTs.

August

The IMF released a new paper focusing solely on exploring the administrative feasibility of FTTs.

The conclusion? “In principle, an FTT is no more difficult, and in some respects easier, to administer than other taxes”.

Enough said.

France and Germany also agreed to table a joint proposal for an FTT – a very welcome development.

September and October

The number of high profile advocates who came out in support of FTTs during these couple of months was remarkable. The (non-exhaustive) list includes:

– French President Nicolas Sarkozy

– German Chancellor Angela Merkel

– Bill Gates, founder of Microsoft

– European Commission President, Jose Manuel Barrosso

– Archbishop Desmond Tutu

– Dutch Prime Minister Mark Rutte

– The Vatican

November

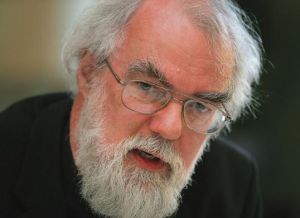

November began with even more high-profile support for the Robin Hood Tax campaign, in the form of Rowan Williams, the Archbishop of Canterbury.

The Archbishop said:

“This has won the backing of significant experts who cannot be written off as naive anti-capitalists – George Soros, Bill Gates and many others. It is gaining traction among European nations, with a strong statement in support this week from Wolfgang Schäuble, the German finance minister.

“The objections made by some who claim it would mean a substantial drop in employment and in the economy generally seem to rest on exaggerated and sharply challenged projections – and, more important, ignore the potential of such a tax to stabilise currency markets in a way to boost rather than damage the real economy.”

Caroline Lucas MP also added to the public pressure on David Cameron by asking him during the PMQs whether he intended to support a Robin Hood Tax at the G20 Summit in Cannes.

As we got closer to the G20, 70 organisations and almost 80,000 people expressed their support for the tax and urged David Cameron and George Osborne to do the right thing and not block progress at the Summit.

The G20 verdict: a coalition of the willing, including France, Germany, Brazil, Argentina and South Africa backed the Robin Hood Tax, and the link between the tax and fighting poverty and climate change became clearer than ever. Bill Gates also presented his excellent report advocating FTTs for their practicality and revenue raising potential. Unfortunately, amidst all this progress, our own government remained one of the key blockers, with even the USA and Russia progressing.

December

As the end of the year approaches, we hope you have enjoyed reflecting over the tremendous progress that the campaign has made in 2011.

*BREAKING NEWS*

It’s not over yet – the support keeps on coming, including from some unlikely sources. Al Gore, Kofi Annan and the new Belgian and Italian governments all came out in support this month.

Mario Monti, the new Italian Prime Minister announced in the Italian Senate “I have informed Brussels that we agree, unlike the former government, to promote a tax on financial transactions,” this is great news and will definitely increase momentum in our favour.

Additionally, with the main blockers, the UK, opting out of the EU-27, an inter-governmental track has become more possible. This looks like a more expedient way to proceed in the new year.

So what does the future hold?

What a year! 2012 has the potential to be even bigger but we must remain clear that revenues raised from the FTT should not be used to bail out European banks or top up the European Commission budget.

It is only a Robin Hood Tax if proceeds are also used to fight poverty and climate change.

Thankfully, President Sarkozy and Chancellor Merkel both agree that proceeds should be used in this way.

So, the UK government has decided to let the financial sector off the hook once more, whilst the rest of Europe progressively moves forward in promoting an FTT that will curb banks’ reckless gambling whilst raising billions in desperately needed revenue.

It is up to all of us here in the UK to keep up the highest level of pressure on our government in the coming months.

WE ARE THE 99%!

More from us next year, but for now, Merry Christmas!

The Stamp out Poverty team.